“The first round of the French presidential elections did little to improve general sentiment. There was some relief that the polls had accurately predicted a second-round runoff between Emmanuel Macron and Marine Le Pen, which Macron is expected to win, but overall uncertainty remains”, writes Mark Robertson, Senior Portfolio Manager Multi-Asset at NN Investment Partners.

This week our Big Data Barometer, focusing on the mood around the French elections, shows a further decline although tentative signs of improvement can be seen.

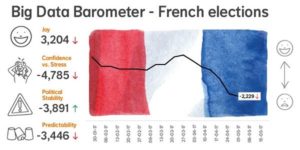

In the graphic below we present the weekly results of the four sentiment indicators we have constructed to assess the mood regarding the French elections. These measures are constructed using a combination of underlying sentiment indices derived from thousands of social media websites, blogs and posts. Together they form a sentiment barometer that helps measure changes in attitudes and emotions around the elections.

The underlying sentiment indices are based on an algorithm that scans the social media universe and converts written words into raw data that can then be analysed in a variety of ways. The use of sentiment indices, and NN IP’s own proprietary methodology for combining them, reflects the same approach that we apply in our asset allocation strategy. This strategy combines both the analysis of sentiment indicators and fundamentals.

The four proprietary sentiment measures shown above – Joy, Confidence vs Stress, Political Stability and Predictability – were developed specifically for the French election barometer. They are constructed so that an increase in the measure reflects more optimism/positivity being conveyed through social media channels. Conversely, a decline in the measure indicates falling confidence/certainty.

The combination of these four sentiment measures makes up our Sentiment Barometer, which assesses the overall mood being expressed in relation to the French elections.

Shortly before the first round of the election all of our sentiment measures were declining. Political Stability and Confidence vs Stress showed particularly sharp declines. After the first round we saw an improvement in Political Stability, which market watchers and political analysts attribute to the apparent increase in the likelihood that Macron, the more mainstream candidate, will win the presidency. The other measures, however, have shown further modest declines, with Joy in particular weakening further.

The picture that emerges is one of some relief that the polls were accurate in predicting the result and that a Far Left vs Far Right battle for the presidency did not ensue. However a great deal of uncertainty remains and the sense that the French electorate is dissatisfied with the political process persists. This impression is supported by the fact that around half of the French electorate voted against the established political parties.

While the financial market response has been overwhelmingly positive to the reduced uncertainty, the same cannot be said for sentiment generally. This week we have seen the two remaining candidates return to the campaign trail in an effort to convince the electorate that they have the policies to address voter dissatisfaction. This week’s live television debate could be pivotal in determining how voter sentiment will be affected going into the final round of voting on 7 May.

We will of course be monitoring our sentiment measures closely to see how the mood is changing. For now it seems the candidates have a lot of work to do to lift voter optimism.